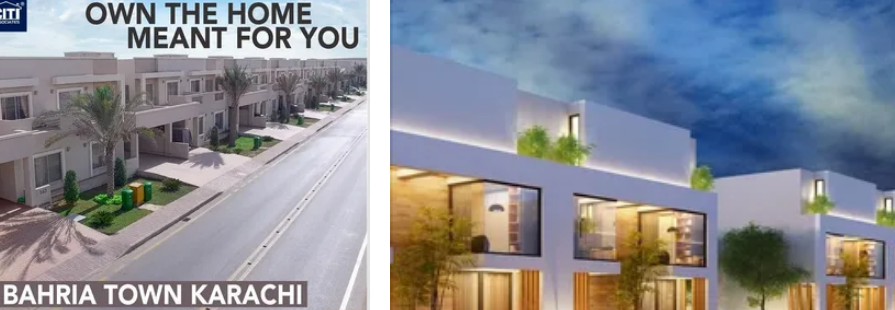

Bahria Town Home Financing

You might have come to this article seeking information on Bahria Town home financing. In this article, you will learn about home finance in Pakistan, how to get a home loan with no interest, and which banks offer loans in Bahria Town. If you have a question, feel free to ask us! We will be glad to help you! We will answer all your questions, from which banks to avoid, to how to get a home loan with no interest in Pakistan.

Bahria Town Home Financing

Bahria town home financing the difficulty of acquiring mortgage for Bahria Town property is high, especially as there are few banks that offer this type of financing in urban areas. In the case of Bahria Town, clean land titles are essential, but in many parts of the country, there is a problem with double file and land grabbing. Fortunately, there are plenty of banks that provide financing in areas with the highest concentrations of high-end residential projects, such as the DHA and cantonment districts.

Moreover, the Bahira Town team has taken over the Escorts Investment Bank, which recently opened branches in Lahore and Karachi. The bank is generating 27pc of its total income from house finance activities for 2020-21, and is currently losing money. However, Bahira Town members are still anxiously waiting for the details of the housing loan. In the meantime, they can get some help from an agent.

Another advantage of this financing is the fact that it is Shariah compliant. If you are a non-resident of Pakistan, you can still obtain a home loan in Bahria Town. The bank has partnered with the Bahria Town development project to offer this financing to interested buyers. By acquiring a loan through this bank, you can enjoy the luxury and convenience of living in a luxury community.

Home Finance Pakistan

Banks in Pakistan are not eager to lend money for Bahria Town homes because they believe that the properties are unviable, but they can. In fact, Bahria Town is one of the biggest housing projects in Pakistan and the banks have become suspicious of it. A report in Dawn magazine noted irregularities in the acquisition of land in the area. Banks, however, have not responded to the report, but it seems that the trend may be about to change.

BankIslami, the country’s leading Islamic Bank, is introducing housing finance in Bahria Town. The new financing option is available for ready-to-live flats and houses in Islamabad for Pakistani citizens and non-residents. The Islamic bank is one of the largest in the country and is a leader in RIBA-free products and services. It has also launched an extensive financing program.

Banks in Bahria Town will now provide housing finance to members of the community. The bank will only provide financing against the construction of the house and not the purchase of plots. The Bahria town member will be able to obtain a loan up to 80% of the market value of the plot. The bank will provide them with a five to ten-year repayment period. Alternatively, they can also opt for a monthly payment plan.

Home Loan Without İnterest İn Pakistan

Home loan withot interest in pakistan the Bahria Town has announced a low cost housing scheme to attract buyers. This scheme is aimed at locals and overseas Pakistanis and is expected to generate huge amounts of customer interest. Its founder Malik Riaz recently bought over 71 percent shares of Escorts Investment Bank Limited, which is a non-banking finance company and not a commercial bank. In fact, it is not even regulated by the banking regulator.

Home loans in Pakistan are facilitated by some banks. You need to have a minimum of 23 years of age, CNIC, and salary slips. Also, you must be in a steady job for two years. The State Bank of Pakistan has recently revised the home loan provisions. You should check this circular to ensure that you understand all the terms and conditions of the home loan. Remember that you should always pay off the loan on time.

BankIslami and Bahria Town have a long history of providing new residents with affordable housing and financing. The collaboration between the leading Islamic Bank and housing scheme giant will make it easier for hardworking Pakistanis to live the dream. With the latest move, you can now finance your dream home without interest in Pakistan and get the house of your dreams today. If you’re interested in owning a home in Bahria Town, don’t wait any longer. You can now enjoy a luxurious and convenient lifestyle at Bahria Town.

Which banks offer loans Bahria Town

Which banks offer loans Bahria Town as a leading Islamic bank, BankIslami has recently introduced a Shariah-compliant home financing program that allows non-residents and Pakistanis to purchase property in Bahria Town. In addition, the Bank’s lending criteria are more flexible and lenient than those of conventional banks. Moreover, the bank has a wide array of products and services to suit borrowers’ needs.

Escorts Investment Bank Limited has two branches in the city. Its new branch in Bahria Orchard Lahore was launched last week. The bank’s management includes Admiral Ahmad Hayat, the chief guest at the opening ceremony. Escorts offers home financing and money market activities. It also provides advisory services. This is a great option for those looking to buy or construct a home in Bahria Town.

Commercial banks have been reluctant to provide home financing to Bahria Town residents because they do not have a clear, undisputed title to the land. However, the project’s history of litigation against the bank, personal corruption allegations against Malik Riaz, and general mistrust of housing projects has made it difficult to obtain finance. However, there is a solution. In the meantime, residents can apply for cheap home financing in Bahria Town.

Which bank finance in Bahria Town Karachi

Which bank finance in Bahria town karachi the Bahria Town Karachi is undergoing major development. As a real estate developer, the company is taking the necessary steps to encourage the construction of new homes. Aside from offering low-interest mortgage loans, it has also launched a housing finance scheme. The bank will provide finance to Bahria Town home buyers on a long-term basis. The bank expects to earn 27 per cent of its overall income from house finance in 2020-21, which is a significant increase. However, the bank is already operating a loss since 2016.

There are four types of finance in Bahria Town Karaachi. The Escort Investment Bank Limited is one such bank. This bank also offers financial planning and advisory services to help its customers. The bank has a long-standing tradition of undertaking projects for Pakistan citizens. It also has a separate entrance on the M9 Expressway. With such services, Bahria Town Karachi is one of the safest and most accessible master-planned communities in Karachi.

BankIslami is one of the leading Islamic banks in Pakistan. The bank will provide financing for ready-to-live flats and houses, both for residents and non-residents. The bank has 340 branches across Pakistan and aims to provide the best products and services for both residents and non-residents. Its innovative financing options can help its customers finance their home in an easy, quick, and hassle-free manner.

Which bank is best for home financing in Pakistan

Which bank is best for home financing in Pakistan in the current market, building a house is not a very easy task for most people, especially the middle class. But with the help of home financing, it has become much easier for them. They just have to pay their bank monthly and reap the benefits of owning a house. These loans also help them build a house for a second or third home, allowing them to claim the housing loan interest as a tax deduction.

In the recent past, the Bahria Town has announced a low-cost housing scheme for both overseas Pakistanis and residents. This scheme is bound to attract customers. It is also worth noting that the bank has acquired 71 percent of the shares of Escorts Investment Bank Limited (EIBL), a non-banking financial company. However, the bank is still regulated by the Securities and Exchange Commission of Pakistan and is therefore not a commercial bank.

Meezan Bank offers loans to people with an income of around Rs. 40,000. To qualify for the home loan, you need to have a minimum of Rs. 40,000 monthly salary. To qualify, you must have a 12-month bank statement and 2 years of employment proof. You can also get home financing from the Saadiq Home Financing division of Standard Chartered. Loan amounts from Rs3 million to Rs30 million are available for purchase. Payment is made in 12 to 240 monthly installments.

Which Is The Biggest Bahria Town

Which is the biggest Bahria town when buying a home, which financing company should you choose? In Bahria Town, the biggest home financing company is Escorts Investment Bank. This bank will give you greater relief if you are a first-time buyer and can provide advice on houses for sale on installments. The House Building Finance Corporation is another option, but you should know that it will be more difficult for you to obtain a loan with this option.

There are a few options for financing a home in Bahria Town. The most obvious choice would be to buy an existing housing finance company. The government is reluctant to sell the HBFC, and the only other option would be to build the company from scratch. However, this may have been too much of a challenge for Bahria Town to undertake, as it does not have the expertise to create a financial institution from scratch.

Escorts Investment Bank Limited, a subsidiary of a real estate developer, is another option for financing Bahria Town homes. It has been an NBFC for five years, but did not have a good track record in consumer finance in Pakistan. Escorts Investment Bank has been in the business for a long time, but has suffered losses. Besides, it lacks the capital, talent, and relationships to be an appropriate housing finance provider.

I have reached the end of my content related to our topic Bahria Town home financing. You can access topics related to the finance category, such as our Bahria Town home financing topic, from our category. For more content like this, you can search on Dec basis of Google.